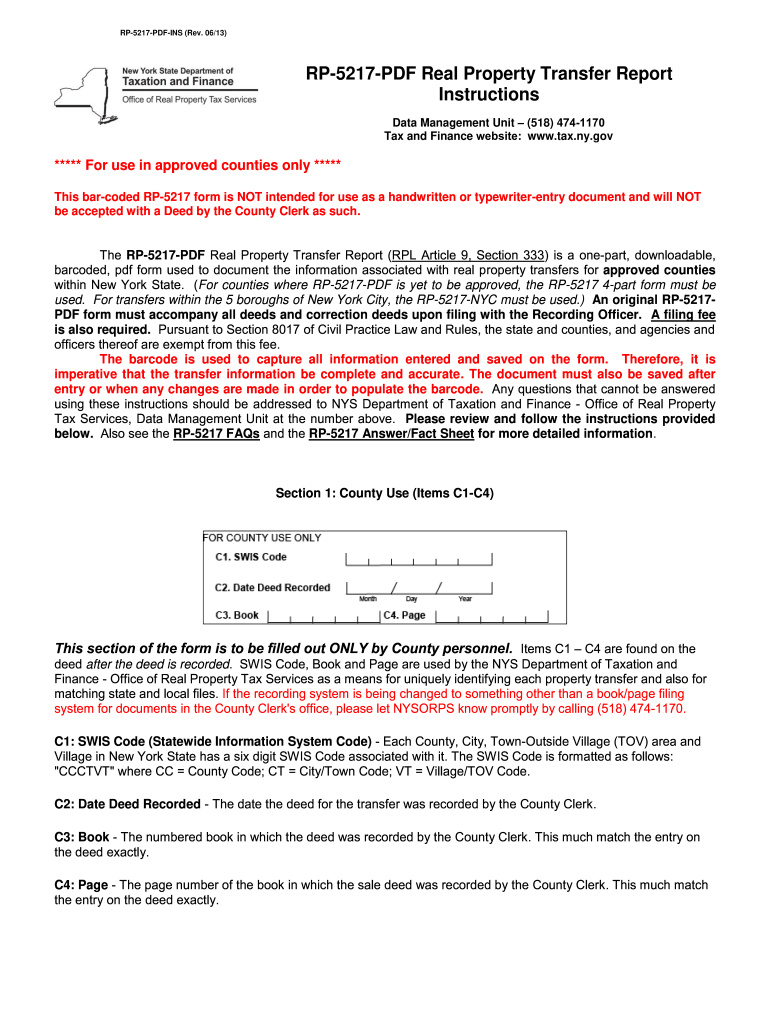

Who needs an RP-5217 Form?

An RP-5217 Form is necessary for County Recording officers, whose duties are to submit monthly reports to the Office of Real Property Tax Services about real property transfers.

The form must be filled out by the parties to the real estate transaction, the Seller, and the Buyer, and partially by the County Recording personnel as well.

What is the Form RP-5217 for?

Form RP-5217 is a Real Property Transfer Report, which must be completed in order to record the information regarding real property transfers for approved counties within New York State.

Is RP-5217 Form accompanied by other forms?

There is no need to accompany the RP-5217 Report by any other form. However, the Real Property Transfer Report itself must be provided as a document supporting the deeds and deed corrections.

When is RP-5217 Real Property Transfer Report due?

The submission of the RP-5217 is not restricted by any specific due dates. Thus, as it is aimed to accompany the deed, it should be filled out consequently.

How do I fill out the Form RP-5217?

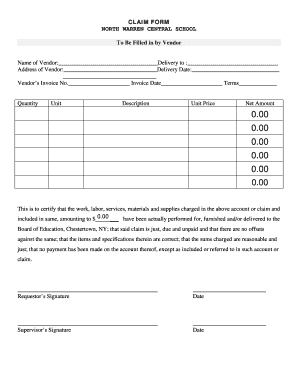

The following items must be clearly filled out in the Real Property Transfer Report:

- Property Information

- Sale Information

- Assessment Information

- Certification

Where do I send the Real Property Transfer Report Form?

The form can be either filed in front of the Recording Officer and with their help or just directed to them for processing after the form’s completion by the parties.